Statement of Patricia Baker, Senior Policy Advocate, in response to SNAP & MassHealth application change

For too long, Massachusetts households in need have faced bureaucratic obstacles in order to access benefits they need to make their rent payment or put food on the table. For anyone seeking assistance, times are already difficult for them and we should be doing everything we can to ease the burden.

It’s Time to Lift Children Out of Deep Poverty

The Boston Globe had it right in their January 25, 2022 editorial piece Ending welfare as we know it – again: states should tie their cash assistance payments to inflation so that poor, vulnerable families don’t get squeezed by rising costs.

Pandemic Related Unemployment Benefits Have Ended. Now What?

On September 4th, the pandemic-related unemployment benefits offered by the federal government ended. Those included:

On September 4th, the pandemic-related unemployment benefits offered by the federal government ended. Those included:

- Pandemic Unemployment Assistance (PUA), for many left out of traditional unemployment;

- Pandemic Emergency Unemployment Compensation (PEUC), which extended the weeks for regular unemployment;

- Federal Pandemic Unemployment Compensation (FPUC), an additional $300 a week for all claimants; and

- Mixed Earners Unemployment Compensation (MEUC), an additional $100 to certain workers.

It’s a loss for so many vulnerable individuals and families struggling to put food on the table. In Massachusetts alone, more than 300,000 people have been impacted. There are many reasons individuals who lost unemployment are not able to access work right now – including child care barriers, lack of access to remote work jobs for those who are immunocompromised, concerns regarding the Delta variant of COVID-19, and more. For those who are able to access work, the hours or pay may not be consistent or pay a living wage. Benefits from the Department of Transitional Assistance (DTA) are a critical tool to ensure individuals and families can put food on the table.

So now what?

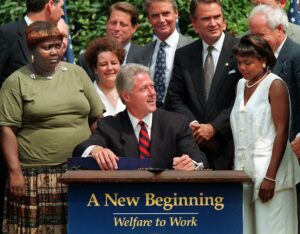

Reconsidering Welfare Reform

Twenty-five years ago this week, President Clinton signed “The Personal Responsibility and Work Opportunity Reconciliation Act” – better known as the Welfare Reform Act – into law. The bill was controversial at the time, especially among anti-poverty advocates who worried that the law’s impact on people living in poverty would be significant and significantly harmful.

Twenty-five years ago this week, President Clinton signed “The Personal Responsibility and Work Opportunity Reconciliation Act” – better known as the Welfare Reform Act – into law. The bill was controversial at the time, especially among anti-poverty advocates who worried that the law’s impact on people living in poverty would be significant and significantly harmful.

Turns out our fears were very much founded.

The results of the law have been devastating. Income inequality has grown exponentially in the last thirty years. According to the Center for Budget and Policy Priorities, “the best survey data show that the share of wealth held by the top 1 percent rose from 30 percent in 1989 to 39 percent in 2016, while the share held by the bottom 90 percent fell from 33 percent to 23 percent.” There are many structural reasons for the concentration of wealth, not the least of which is the fact that sometime in the 1970s, wages and productivity decoupled, meaning that while people were working longer hours, that hasn’t been reflected in their paycheck. But it’s also not difficult to imagine that our porous social safety net has also played a role.

As inequality becomes more prevalent in our society and poverty ever more punitive, we all realize that the time has come to rebuild our safety net. It’s time to reform welfare reform.

FindYourFunds.org Helping Vulnerable Massachusetts Residents

The Massachusetts Law Reform Institute assisted The Shah Family Foundation in launching a centralized website last month called FindYourFunds.org. The site helps Massachusetts residents access federal cash payments through expanded federal tax credit programs. These programs include the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and Economic Impact Payments (also known as stimulus checks). Children’s HealthWatch, Greater Boston Legal Services, and Massachusetts Association for Community Action (MASSCAP) also collaborated on the website.

The Massachusetts Law Reform Institute assisted The Shah Family Foundation in launching a centralized website last month called FindYourFunds.org. The site helps Massachusetts residents access federal cash payments through expanded federal tax credit programs. These programs include the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and Economic Impact Payments (also known as stimulus checks). Children’s HealthWatch, Greater Boston Legal Services, and Massachusetts Association for Community Action (MASSCAP) also collaborated on the website.

“The pandemic caused an economic crisis that has laid bare the stark, systemic inequities and challenges facing low-income families across the Commonwealth, especially Black and Latinx communities,” said our executive director, Georgia Katsoulomitis, at the time of the launch. “Our lowest income households are the most likely to be left out of this critical federal relief. FindYourFunds.org connects families to the multilingual information they need and is a resource state agencies can share broadly with families across the Commonwealth. FindYourFunds.org will increase access and decrease barriers.”

The site is helping people from across the Commonwealth access the support they need during these still-challenging times. As the Boston Globe reported, the IRS has estimated that about 58,000 children will miss out on the Child Tax Credit unless they are connected to the tax system. Since June 1, about 140,000 unique visitors have visited FindYourFunds.org. There is a clear need for assistance among vulnerable individuals and families and this site is helping to address that need.

FindYourFunds.org is a simple, one-stop-shop with information on who is eligible for these programs and how to apply, as well as links to free resources that provide guidance and application assistance. If you believe you qualify for additional support – or know someone who does – please make sure to visit the site.